The Math doesn’t lie–and yes, it’s been done by an Astrophysicist!

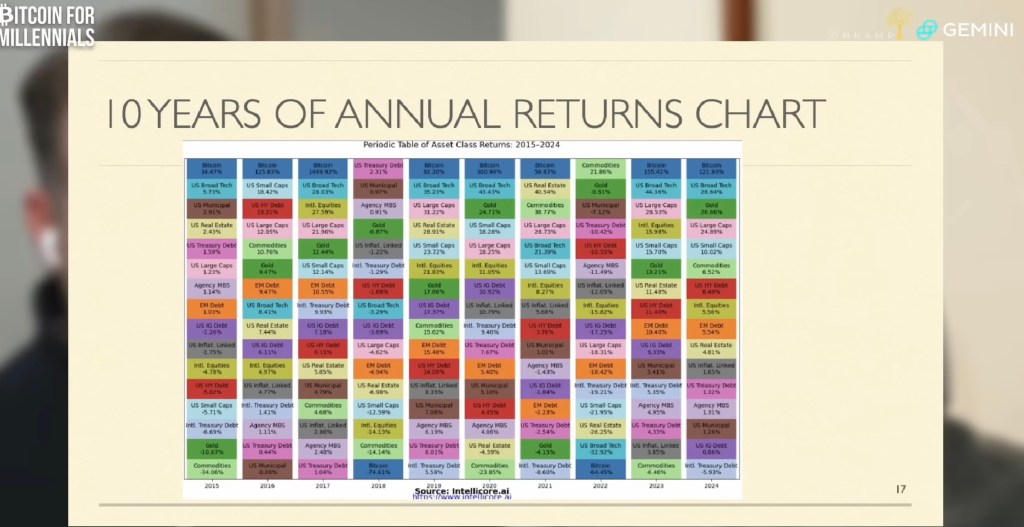

Let’s look at the facts: Bitcoins’ returns have beat all other asset classes for the past ten years. US Treasuries came in at number one in 2018, and Commodities came in First Place in 2022. . . .All other years BITCOIN!

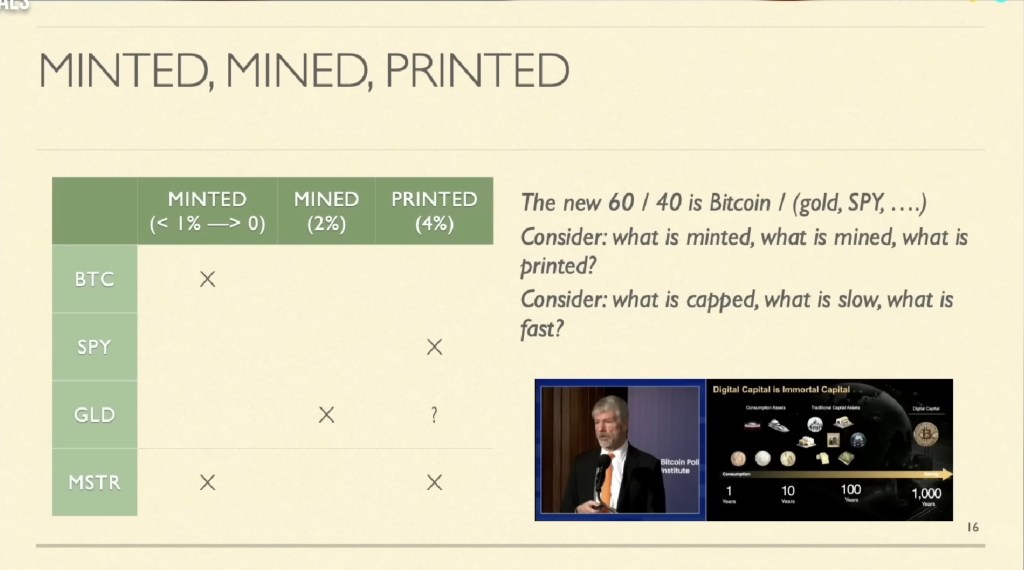

As Rick Rule likes to point out, if we regress to the mean as a percentage of allocation to asset classes of two percent to Gold, hovering in 2025 at point five percent, to say, an additional one point five percent increase–would, for example, take GDX and GDXJ to a price well over one hundred–and gold price in ounces, to the moon! Many other experienced Market Makers on YouTube also now say the old 60 / 40 allocation breakdown in your retirement portfolio should shift with a twenty percent allocation in GOLD (and / or commodities) and twenty in AI or Tech or Crypto, with the standard 60 in stocks or passive ETF’s. The short form, to save you countless hours on YouTube: Is to Allocate for MINTED, MINED, AND PRINTED. (We now all know where printed get’s us.)

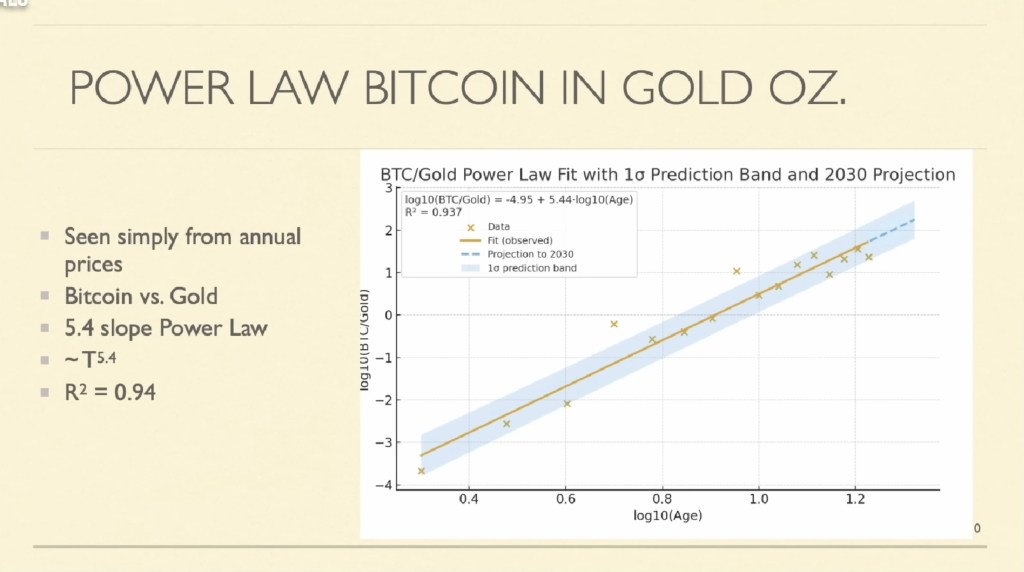

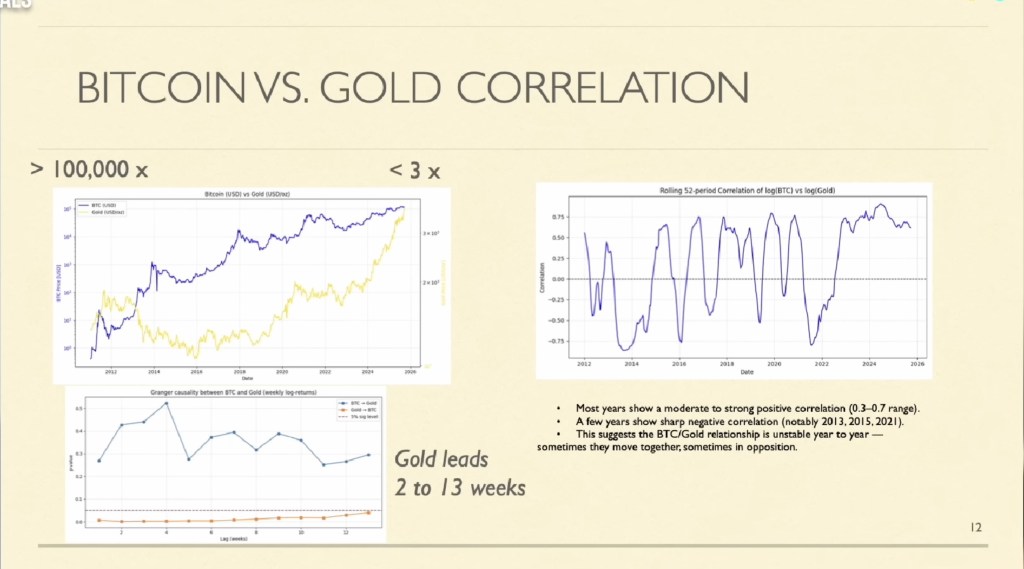

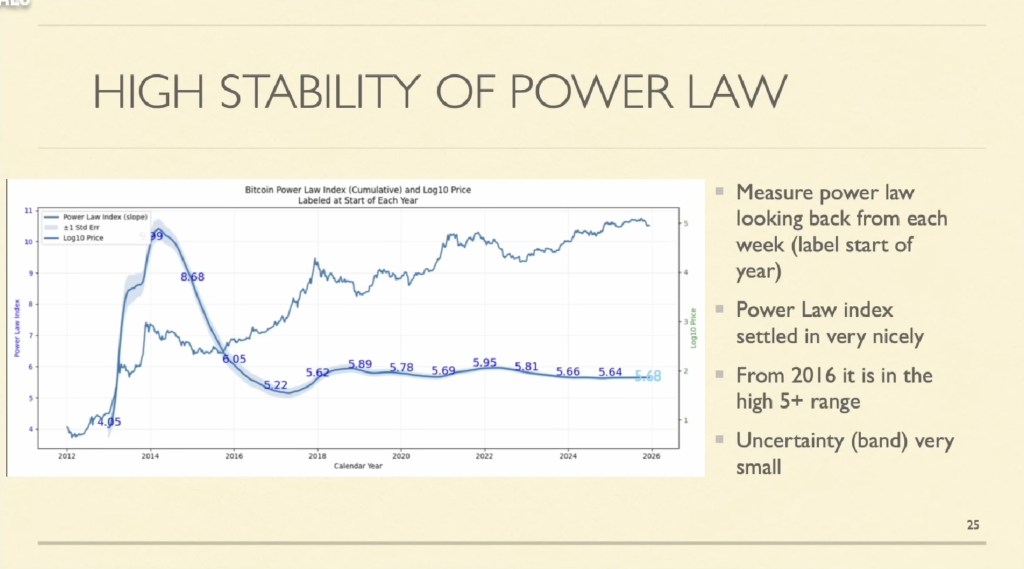

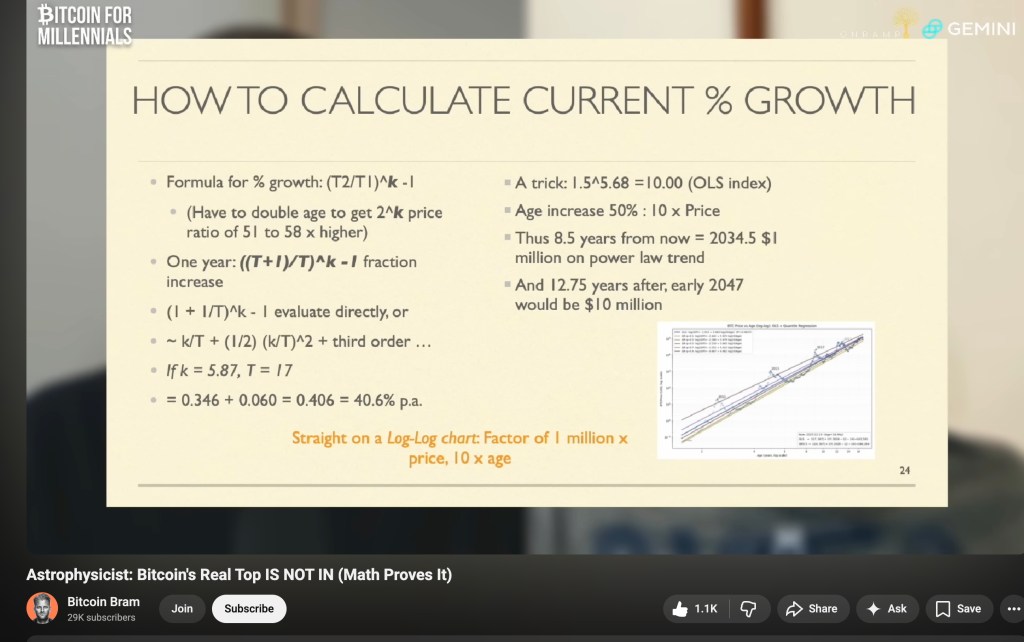

We keep hearing that Bitcoin is now more mature and stable, with friendly powers in the Executive Branch, and large institutions such as banks, now buying more Bitcoin and Stablecoin postitions in their own created ETFs. This graph above shows the standard up-and-to-the-right chart. The slope Power Law is the highest with BTC: more than the S & P, and more than gold (by a sliver-not silver) and the R squared number is so close to 1 that there is almost a 1-to-1 correlation with Bitcoin vs. Gold! Take a peek below on these three graphs:

The below graph does indeed show that the faded shaded light-blue x1 correlation is narrowing at a stable 5.86 ratio.

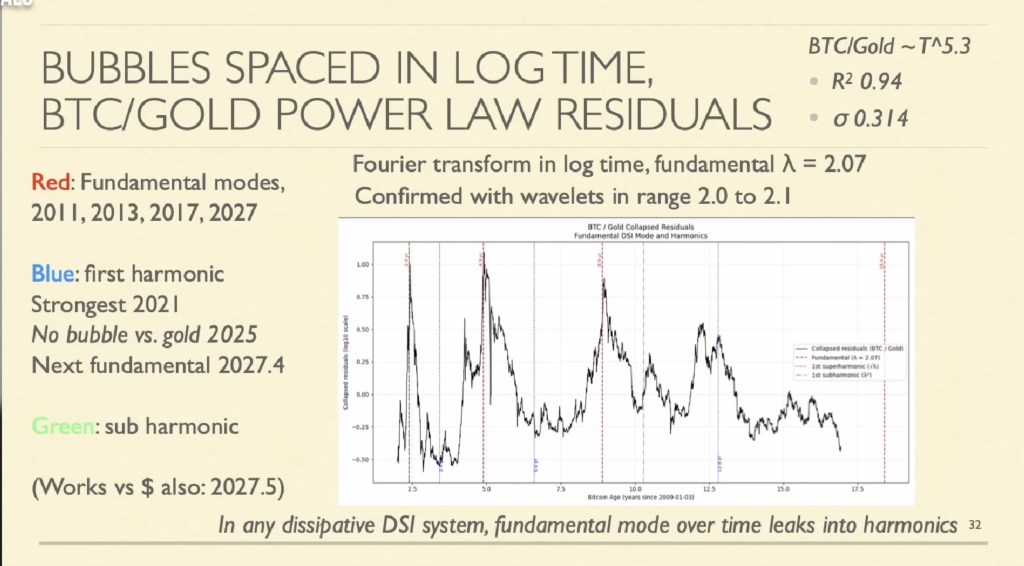

The chart below is not a Silver Widow-Maker chart, but a prediction of the next high in MSTR and BTC: mid-year 2027. (Although the work by Ryan Hogue does show May of this new year, 2026 may a ride to a peak in September 2026.)

Here’s the relieving, take a breath good news that is–keep buying MSTR and ETHA and other such tech-treasury related stocks–NOW WHILE THE PRICE IS LOW–so you don’t have to feel left out of the silver and gold markets’ rally. Buy Low sell High, remember? This is not my advice, but common standard practice as seen on YouTube podcasts. Ka-peesh?

Once again, this is the chart of the BTC/Gold power law residuals, which should make your Levi’s rise into a flush of excitement for the coming year of 2026 to 2027!

You owe it to yourself to watch the latest YouTube https://www.youtube.com/watch?v=hzN7sCO0maY video from BRAM, with astrophysicist Stephen Perrenod, to clarify this four year cycle thing:

As Bitcoin travels up the log chart, the time between peaks L e n g t h e n s, N’est pas? Bueno – mi hitijas y mi hitijos! All the BS by blocking the free markets in silver and changing the rules at the last minute–could be a bull run for MSTR and BTC-USD. As Ralph Kramden would say, “To the Moon Alice, To the Moon~”