Sung to the tune of Burl Ives Christmas Ring: “Silver and Gold, Silver and Gold . . .

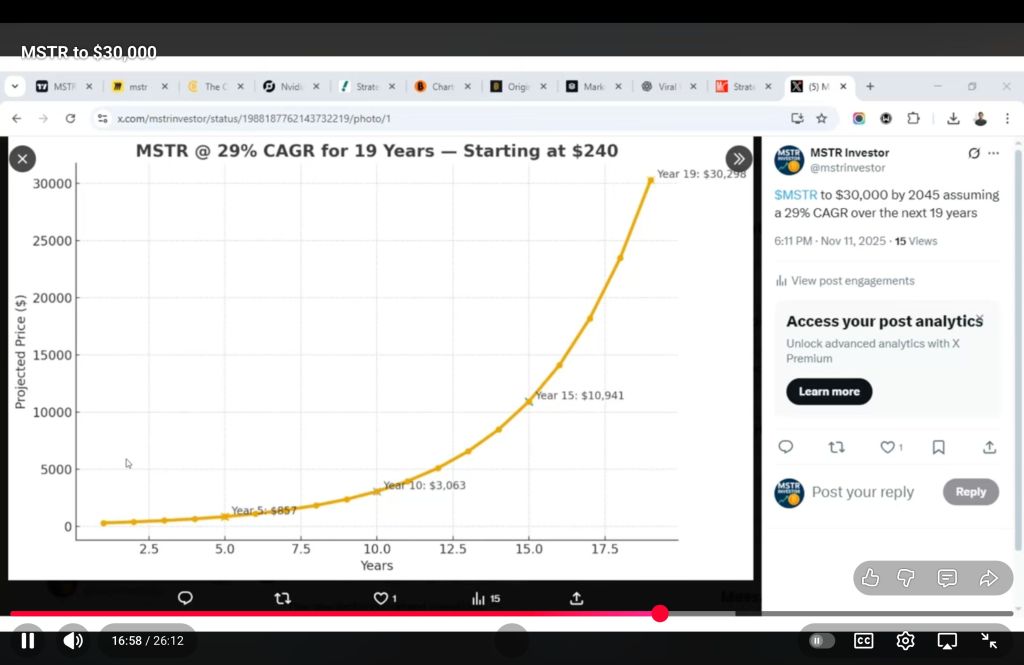

I’m down about 14,000 dollars in 2025 on my brokerage account with MSTR and BITO (not to mention MSTU–realized and unrealized losses, LoL!) because I kept doing the same stupid thing over and over and expected different results. As Michael Saylor has been trying to tell me, I have to keep my MSTR Strategy shares for at least four years. And if I could wait to ten years–the results would be breathtaking. There’s a metric called CAGR*,

*CAGR stands for Compound Annual Growth Rate, a financial metric showing the average yearly growth of an investment over a specific period, assuming profits are reinvested, providing a smoothed, single rate to compare different investments easily. It’s useful for long-term planning and comparing investments with varying annual returns by smoothing out volatility, revealing the constant rate needed to grow from a starting to an ending value.

Sure enough, if I look back at a block of a four year time-frame, I could have seen a huge appreciation in my Bitcoin holdings thru the ticker MSTR, Strategy, had I not kept panicking and hitting the sell button over-and-over like a broken record. So here’s my big whoop-de-whoop on MSTR and Bitcoin for 2026, to show myself I’m not just your run-of-the-mill moron.

Below are some good screenshots about how MSTR can be a good investment if I follow the rules found in the movie, Fight Club: The first rule of bitcoin (MSTR) is to not sell MSTR. The second rule of MSTR is to not sell MSTR. And the Third Rule of MSTR is to not tell anyone about selling MSTR–and if I don’t have any MSTR, I have to buy MSTR! I have to fight!

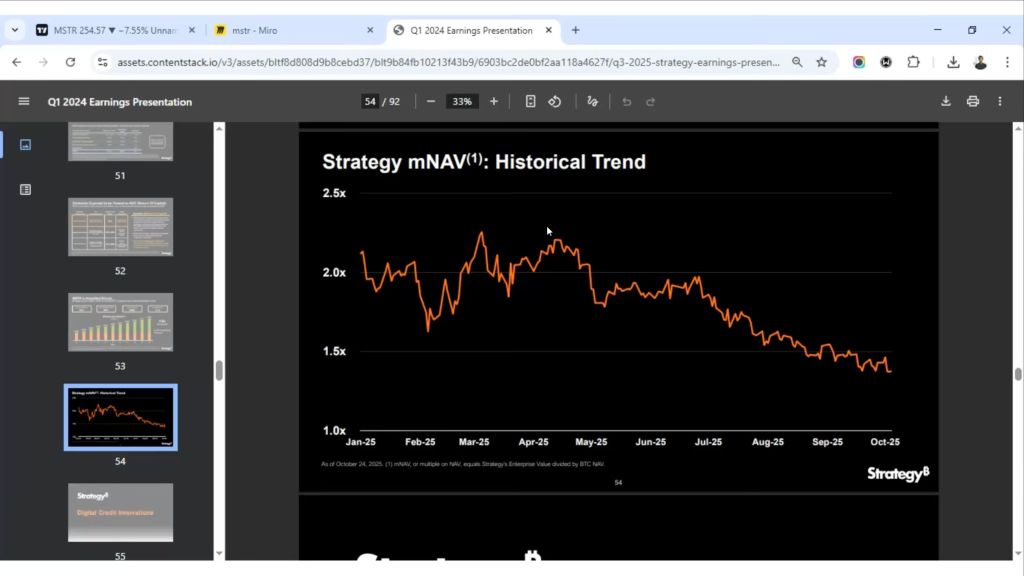

As you can see, MSTR has been like a rock skipping on the water and dropping like a rock since Wed, July 16th of this year, 2025. Indeed, MSTR doesn’t move for long periods of time, in fact, 70 percent of the time.

There’s all this mumbo jumbo about halving cycles and the four year cycles, but if I follow the charting of Ryan Hogue investing on YouTube, the next top may not come until around September of 2026. The bottom not until around MSTR $140. If I can not hit the sell button for at least the next nine months, I should see a huge upside.

Indeed, this drop in the price of MSTR is a great time to buy MSTR: instead of buying high and selling low, I should do just the opposite. MSTR is hated and unloved, and as Rick Rule says, that’s the time to buy–just like anything else, when it’s on sale!

It’s on sale now!

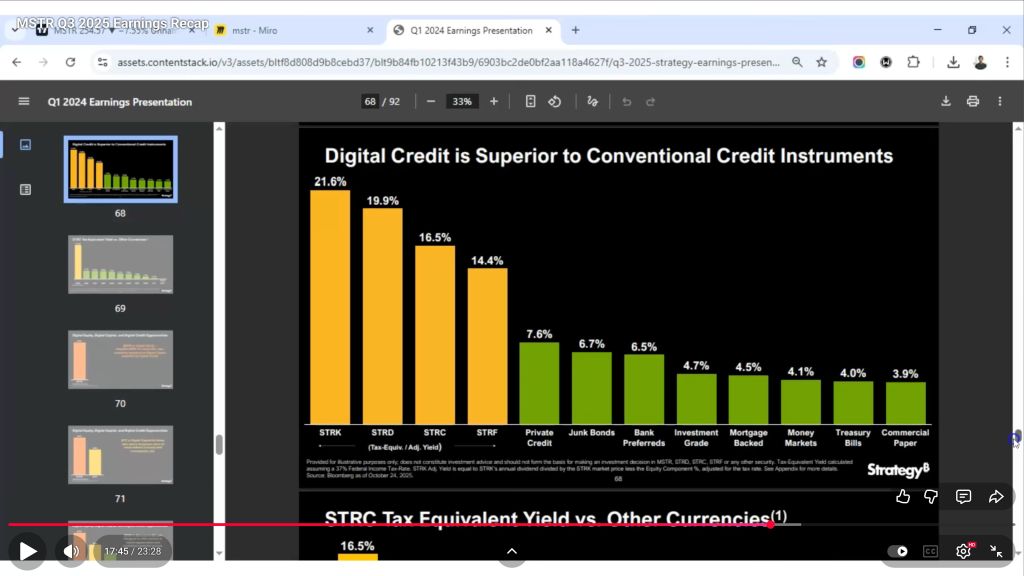

We can see that the Digital Credit equivalent yield to STRK, STRD, STRC, and STRF is far superior to most other forms of non-bitcoin treasury yields above.

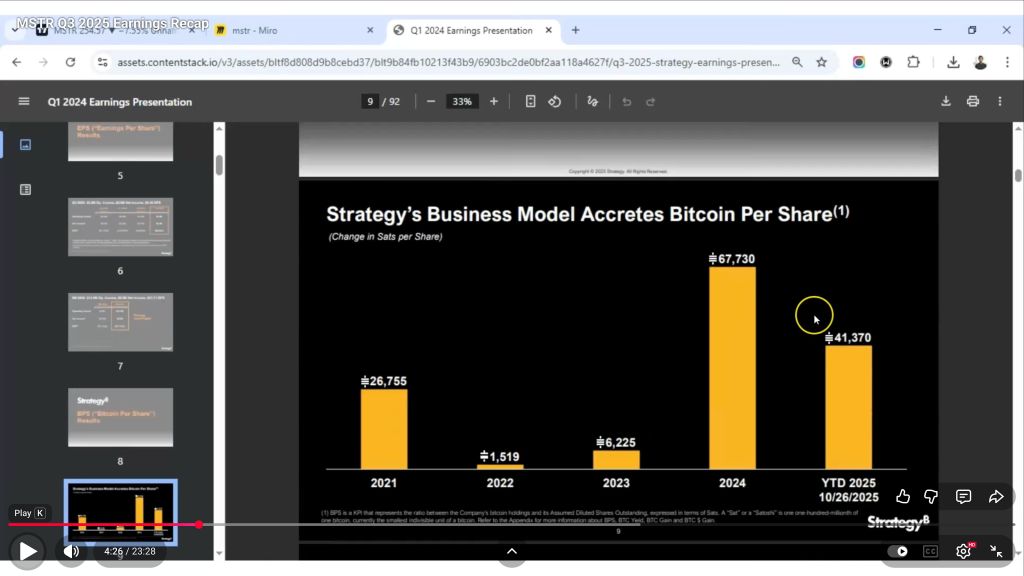

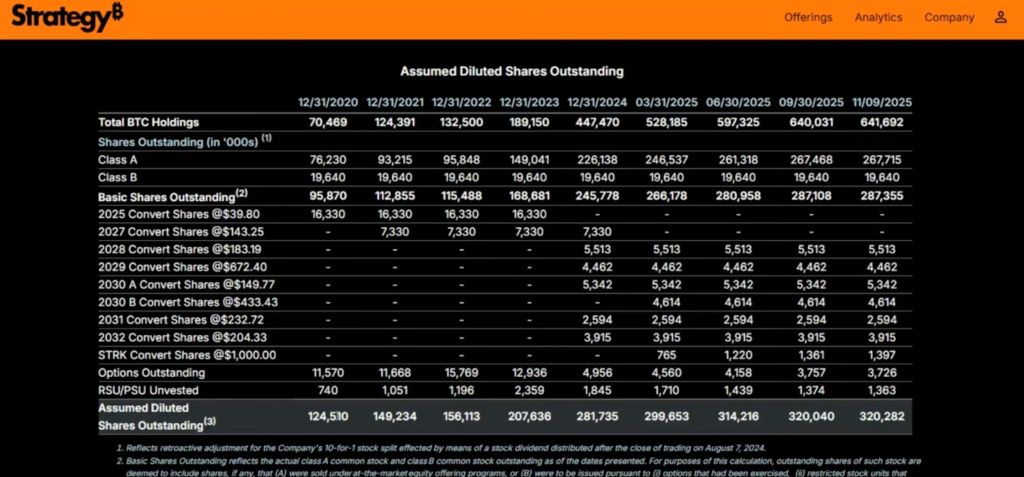

My bitcoin per share is increasing every time Michael Saylor buys more bitcoin, and even though many naysayers believe this is dilution, it isn’t, because the number of bitcoins increases higher than number of shares issued. Yes, fiat currency was used to create a 32-month hoard, such that payments to all these dividend payment preferred shares will stretch beyond September, statistically placing the time horizon to a much more favorable length for accretive increases.

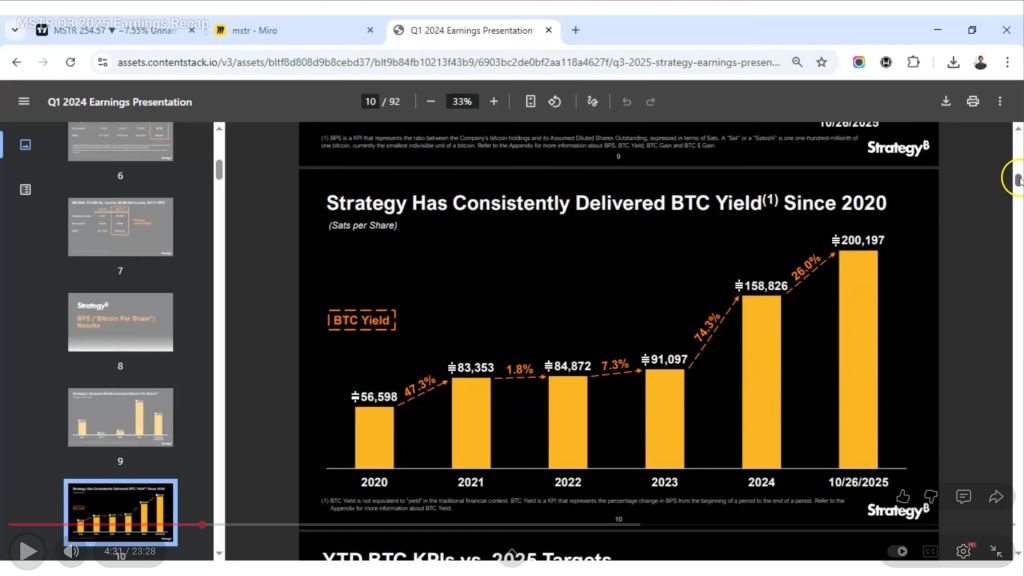

Yield definitely goes up over time, as we see above. Perpetual Preferred Credit is being seen as much better than the debt issuance from government treasuries!

I been acting like I have temporary capital with withdrawal risk! We see below that the numbers keep getting bigger:

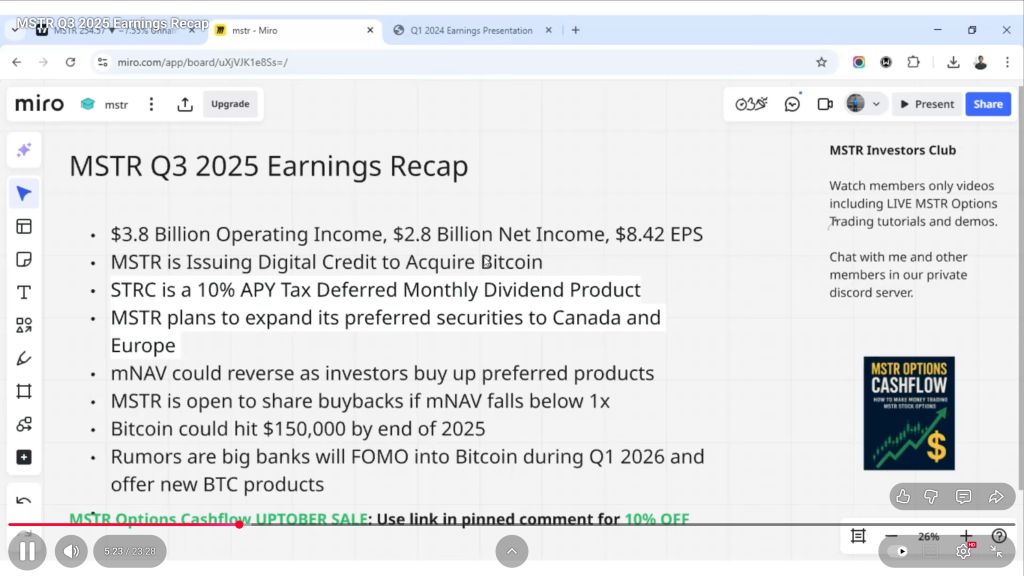

And Earnings Recap looks good, too:

The value will continue to go up if I continue to HODL:

Strategy is and has been staying at the top of annualized return:

What black swan events could happen? How about the shutdown of trading silver! What’s going to happen when retail buyers can’t buy silver due to a government imposed Silver rule 7? I think that silver has taken the steam out of bitcoin, but perhaps, not for long.*

*AI Overview

Silver Rule 7 was a critical emergency rule enacted by the Commodity Exchange (COMEX) (now part of CME Group) on January 7, 1980, to halt the speculative silver bubble inflated by the Hunt brothers, imposing strict limits on leveraged (borrowed money) silver purchases, which triggered massive margin calls, market panic (Silver Thursday), and ultimately, the Hunts’ financial ruin as they couldn’t cover debts, leading to market collapse.

The only thing is, there is no speculative bubble on silver this time. It’s different. We’re running out of silver in the west, as Peru and Mexico have stopped shipping silver. China has also blocked silver from being exported out the country. Whoops. Oh well, we don’t produce that many EV cars or solar panels! Ha.