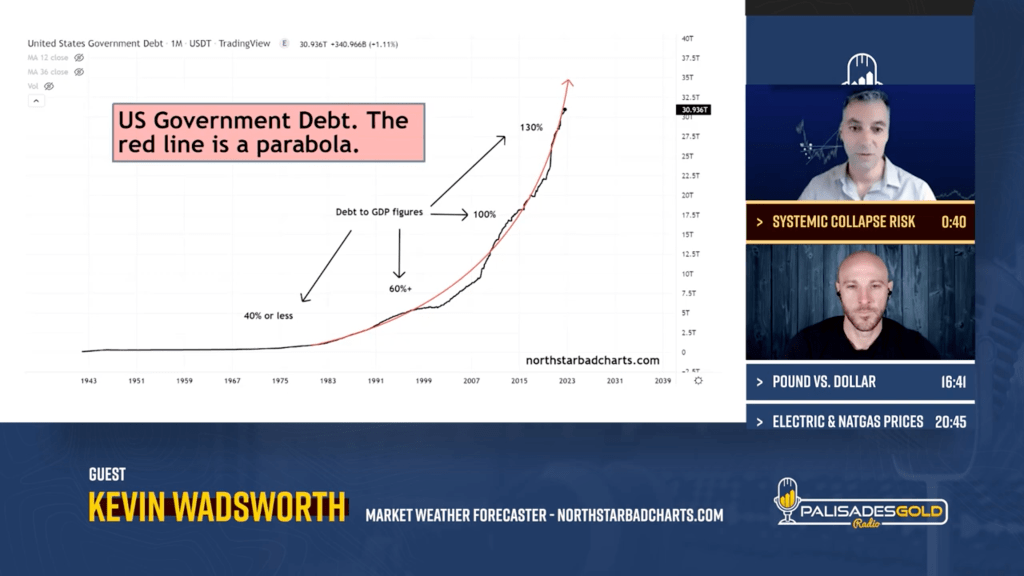

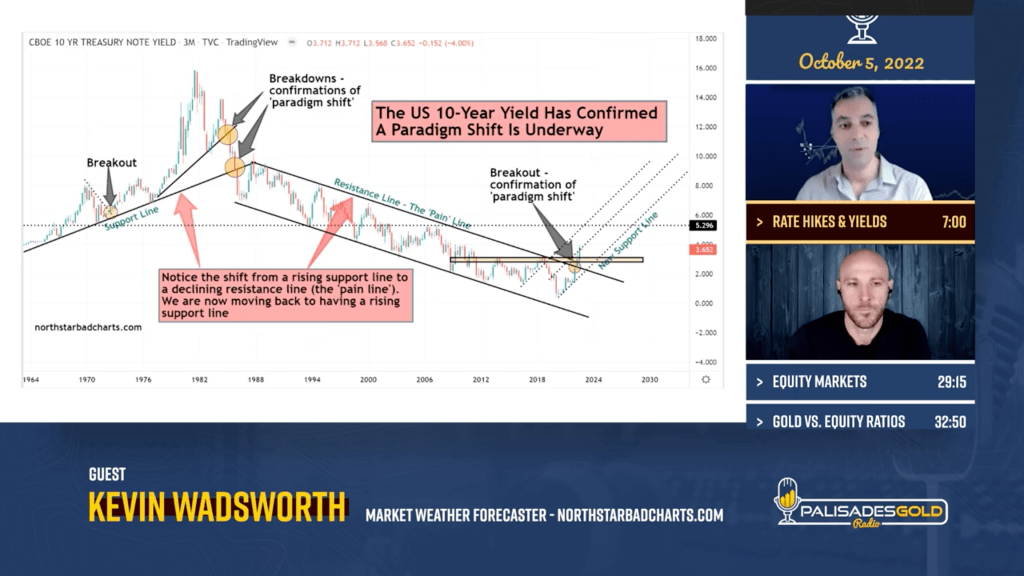

While things like inflation seem to be unpredictable and labeled as a trailing indicator, one thing everyone seems to know off the bat–is that we’re all going into debt. Covid stimulus checks and staying home to avoid a commute to the office, saved us a lot of money. But two years later, what with the housing and rent situations, along with grocery prices and utility bills–things seeming to be spiraling out of control. Nothing paints this picture better as this above graph in Tom Brodrovick’s YouTube host channel on Palisades Gold Radio with guest Kevin Wadsworth.

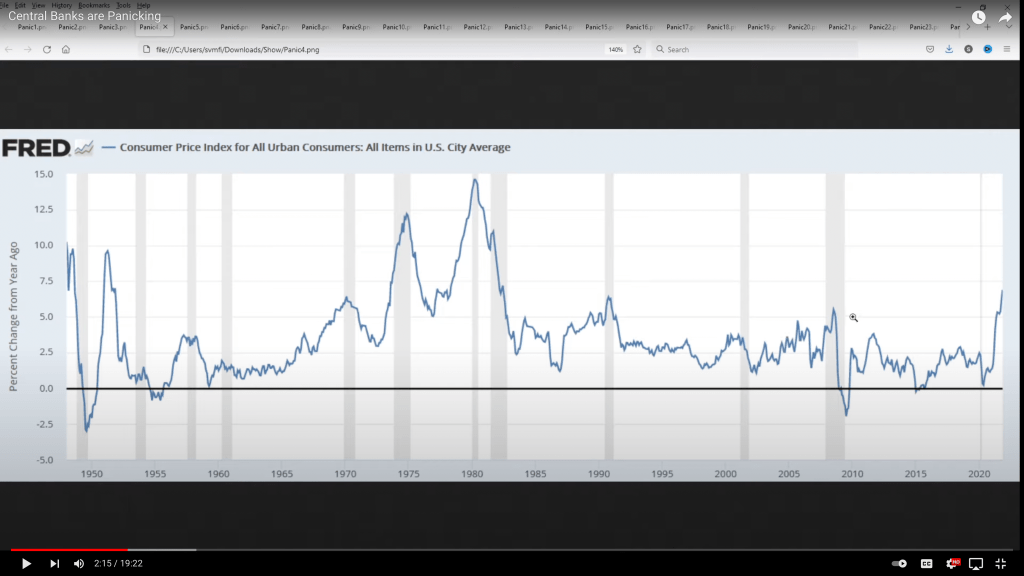

Indeed, studying the charts on popular YouTube channels of Gold and Finance, a shocking picture emerges not really shown on major media outlets. Here’s a FRED graph of Urban CPI:

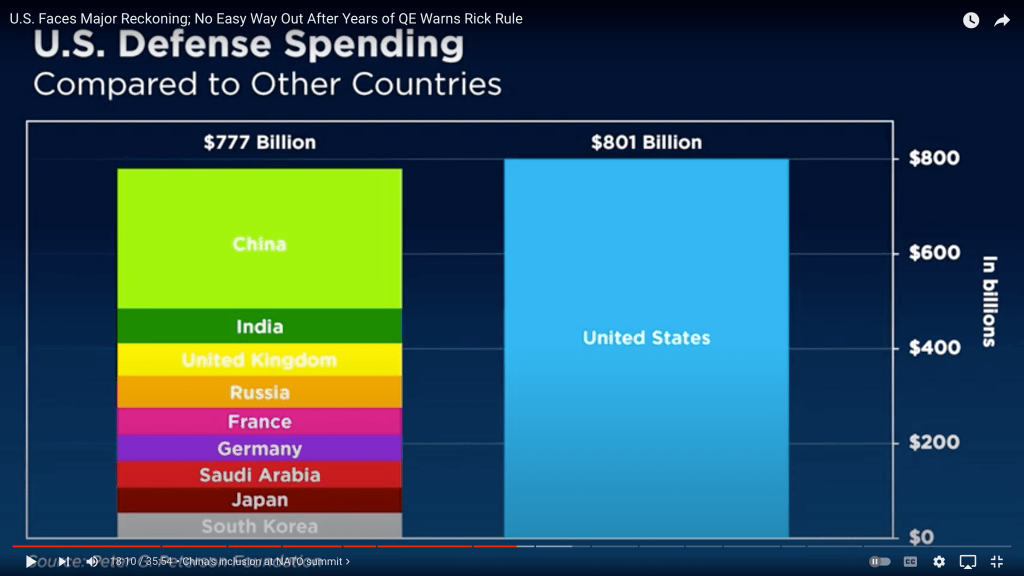

Consumer Price Index notwithstanding, we see the rush to spend on Covid has now been unleashed to Eastern Europe and the 107 billion dollar spending spree on arms for Ukraine. Joe says that this isn’t a blank check (like the 17 wars fought under Obama), but we now have heard from the mainstream media that our spending in Ukraine has topped 100 billion. Okay, it’s not a blank check Joe, but it sure is a big amount of money. Could we have started an high speed Mag-Lev train from Denver, CO to Indianapolis, IN along I-70? How about complete new highways with small hybrid nuclear powered electrical grid updates, wayside battery charging stations, and self-driving pod controls? We could use the two trillion collected by the bankers in 2008 to also fund this infrastructure. Oh, ri-i-i-ght, we need it for defense:

No inflationary problem here. Looks like all the countries on the left are joining Russia and China to stop paying in dollars, trade in gold, and stay away from the Swift system of money exchange, weaponized by US sanctions when countries do things we don’t like. It is so important for us to help a country like Ukraine and keep it “safe.” Good luck with that.

I propose a new label by the FED to calm markets once people begin to realize it isn’t that prices are going up, but that the value of the dollar is falling. The FED announced a term no one ever heard of after the Great Financial Crises in the mid-to-late 2000’s as QE, or Quantitative Easing. We then learned of the Dollar Milkshake Theory, and then, the Twist. It seems obvious the next new term, not found in any economic text book, or any class in middle or high schools, is. . . ta dah. . . The Squeeze. We keep hearing about the Silver Squeeze, such as in last February of 2022, now let’s do it for monetary policy. After all, the amount of money created has nothing to do with inflation, so why not reduce the supply?

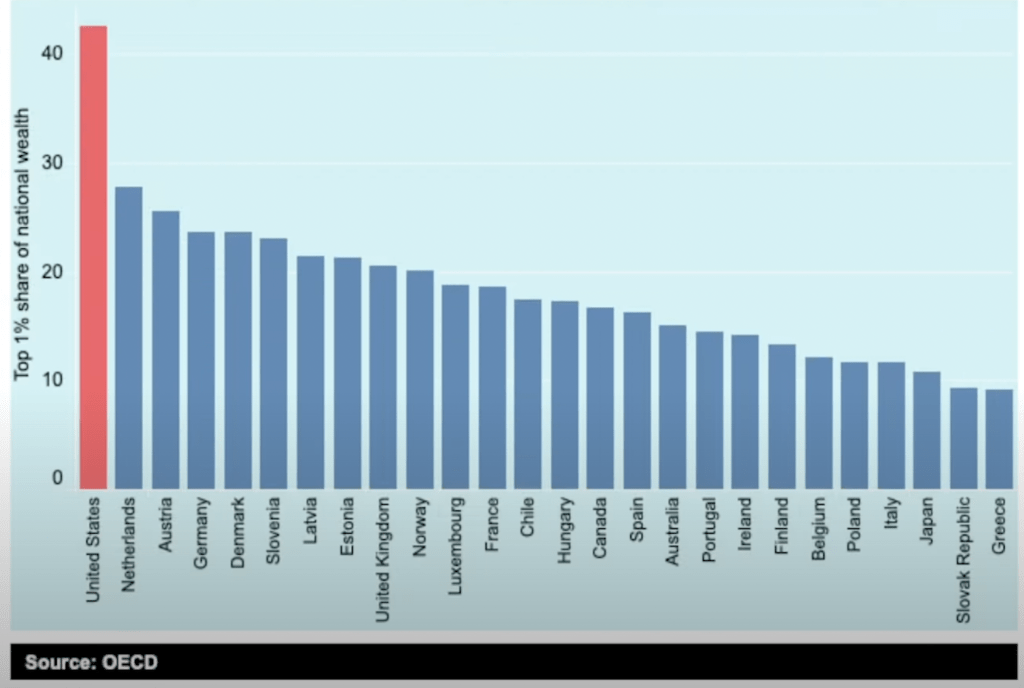

The good news is that the US is the cleanest dirty shirt in the laundry of world wealth:

We in the US enjoy the benefits of the holder of the world’s reserve wealth, but is that priced in dollars or gold?

Everything looks okay here on the above gold tally holdings, but have you been aware of how much gold has been moved since May of last year? Apparently it’s a lot. Well, no matter, because treasury yields are going up. We can save by buying US debt. So how come yields are far below the inflation rate?

According to Colonel Douglas MacGregor on a recent visit on YouTube with Gerald Celente, the only way change will occur is through a collapse or calamity. One thing for sure, the results of the wide economic disparity won’t make things much better:

May the force be with you. Hopefully we will survive when the “Empire Strikes Back.”